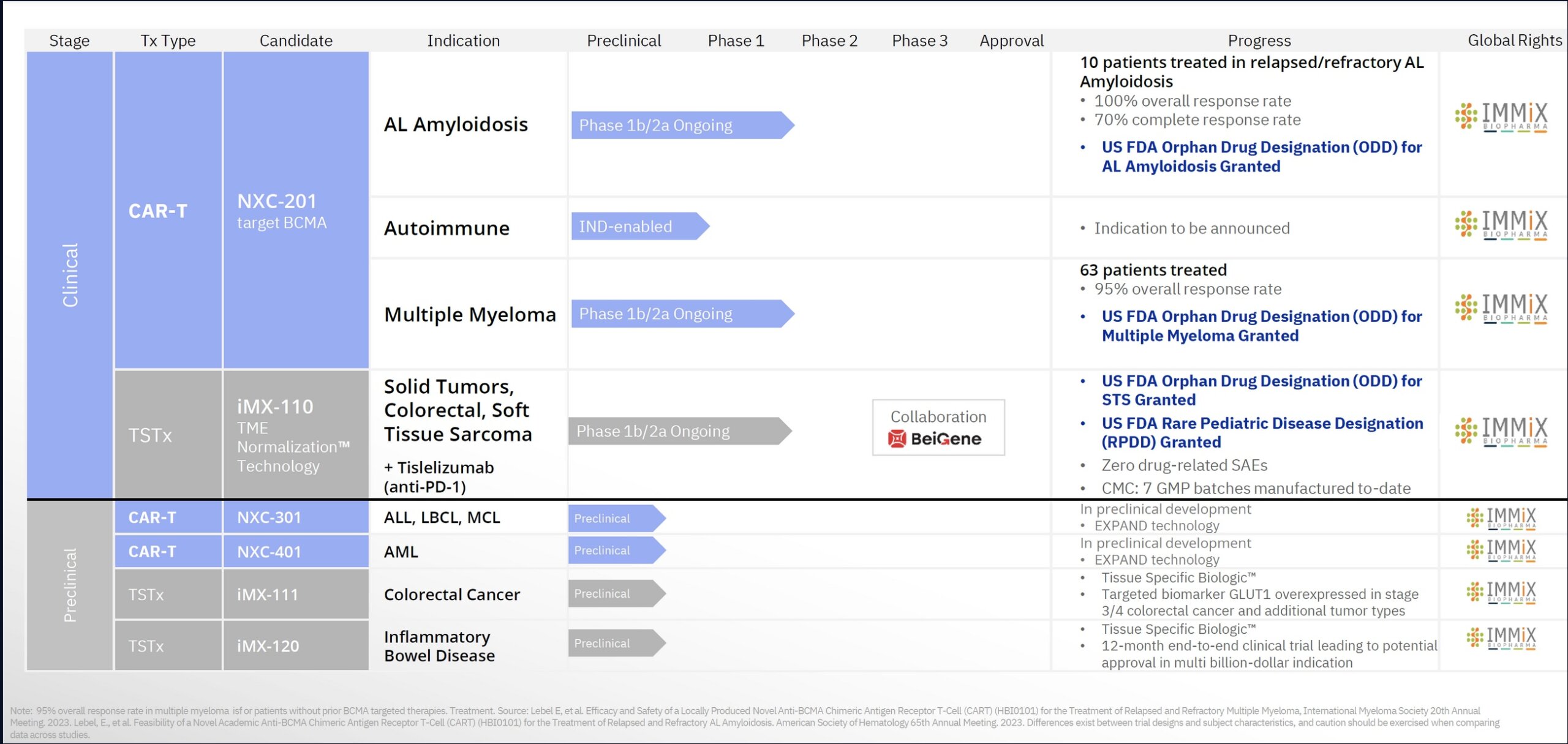

Immix Biopharma (IMMX) is CART-T cell therapy company targeting oncology and immune-dysregulated disease.

Immix’s subsidiary Nexcella (94% owned) focuses a CAR-T therapy, NXC-201, which is in clinical trials for the treatment of multiple myeloma and AL amyloidosis (ALA). The company’s other promising therapy, IMX-110, is being investigated in a Phase 1b/2a study for the treatment of soft tissue sarcoma and a Phase Ib/IIa trial in solid tumors in combination with tislelizumab (Anti PD-1). The company made an oral presentation at 2023 American Society of Hematology (ASH) 65th meeting, making it the first published data for ALA with CAR-T (remarkable accomplishment).

NXC-201

NXC-201 is a BCMA-targeted investigational chimeric antigen receptor T (CAR-T) cell therapy developed to treat patients with relapsed/refractory AL amyloidosis (ALA) and relapsed/refractory multiple myeloma as well as potential expansion into autoimmune indications. 72 patients have been treated to date. NXC-201, the only CAR-T in the ALA universe, is a “blue ocean” opportunity, meaning there are no FDA approved drugs for relapsed patients. It is the first and only “single-day CRS” CAR-T (ie. once and done), enabling patients to return home 80% faster. Clinical performance has been superlative. For the treatment of ALA, as of December 10, 2023, the data show an overall response rate (ORR) of 100%, a complete response (CR) rate of 70% (7/10) and an organ response rate of 60% (6/10). For relapsed/refractory multiple myeloma, the drug has produced a 95% overall response rate. NXC-201 has been awarded Orphan Drug Designation (ODD) by the FDA in both ALA and multiple myeloma. In terms of safety, there were no immune effector cell-associated neurotoxicity syndrome (ICANS) events in the ALA trial to date. Neurological toxicity is one of the major challenges with all CAR-T therapies as is the unpredictability in the onset of CART-T side effects that is a challenge for physicians. Patients typically require hospitalization for weeks or sometimes months for CAR-T treatment. As such, there are a limited number of sites willing to administer CART-T technology. Given the lack of toxicity, single dose regimen and high response rate (greatly increased clinical accuracy), NXC-201 could become the standard of care for treatment of ALA and other indications. The company plans to move forward with a FDA Biologic License Application (BLA) submission for NXC-201 for ALA with data from 40 more patients from an open label, single arm trial that is currently being deployed. The language of the FDA is safety data. In essence, NXC-201 is the equivalent of Phase 3 drug in terms of its clinical progression under ODD, a massive savings in terms of time and money. The average Phase 3 drug company has an EV of $1 billion.

About ALA

U.S. observed prevalence of relapsed/refractory ALA is growing 12% per year according to Staron, et al Blood Cancer Journal, estimated to reach 29,712 patients in 2023. ALA is a systemic disorder caused by an abnormality of plasma cells in the bone marrow. Misfolded amyloid proteins produced by these cells cause a buildup of misfolded immunoglobulin proteins in and around tissues, nerves, and organs, gradually affecting their function. This can cause progressive and widespread organ damage and high mortality rates.

There are no approved drugs for ALA. Instead, a four-drug combination as the new standard of care for most patients newly diagnosed with ALA.

This combination includes:

Daratumumab: A monoclonal antibody targeting CD38 on plasma cells

Bortezomib: A proteasome inhibitor

Cyclophosphamide: An alkylating agent

Dexamethasone: A corticosteroid

ALA TAM

Hematologic cancers market opportunity is $60bn today growing to $120bn in 2028. Multiple Myeloma (“MM”) is 3rd most common blood cancer, impacting 176,404 patients annually, with life expectancy of 5 years. ALA is diagnosed in 14,982 people annually — with no available treatments as standard of care other than bone marrow transplant (only 20% patients eligible). The ALA market was $3.6 billion in 2017, and is expected to reach $6 billion in 2025, according to Grand View Research.

IMX-110

IMX-110 is a tissue specific therapeutic (TSTx) asset. The drug has been awarded Orphan Drug Designation (ODD) by the FDA and Rare Pediatric Disease Designation (RPDD) for the treatment of rhabdomyosarcoma, a life-threatening form of cancer in children. RPPD qualifies the company to receive fast track review and a priority review voucher (PRV) at the time of marketing approval of IMX-110.

Phase 1b/2a Clinical Trial for IMX-110 as Monotherapy: The drug is in clinical development as a monotherapy for soft tissue sarcoma (STS), a $3 billion market expected to grow to $6.5 billion by 2030. The trial is focused on assessing the safety, tolerability, and efficacy of IMX-110 when used alone in patients with advanced solid tumors. This includes a variety of cancers such as breast, ovarian, and pancreatic cancers. The trial aims to determine the optimal dosage and understand the pharmacokinetics of the drug. As of January 2023, 100% of patients treated with IMX-110 completed planned treatment cycles without drug-related interruptions (ie. toxicities).

Combination Trial of IMX-110 with Tislelizumab: In addition to the monotherapy trial, IMX-110 is also being tested in combination with tislelizumab, an anti-PD-1 therapy. This trial is part of the broader Phase 1b/2a studies and aims to evaluate the safety and effectiveness of this combination treatment in patients with advanced solid tumors. The combination of IMX-110, which targets the tumor micro-environment, with an immunotherapy agent like tislelizumab, could potentially offer enhanced treatment efficacy. The recent clinical results, particularly in the treatment of advanced metastatic colorectal cancer (mCRC), have shown promising early outcomes. In the phase 1b/2a IMMINENT-01 trial, 100% tumor shrinkage was observed at 2 months in two evaluable patients who received the lowest dose level of IMX-110 in combination with tislelizumab. This response is particularly notable considering that these patients had advanced mCRC with limited treatment options. Furthermore, among four evaluable patients in a second interim update from the trial, three (75%) experienced tumor shrinkage at 2 months, with one patient (25%) achieving tumor control at the same time point. These patients had undergone a median of eight prior lines of therapy, all with mismatch repair–proficient relapsed/refractory mCRC. Importantly, no dose-limiting toxicities were observed in the first two cohorts of the trial, allowing the study to proceed with enrolling the next cohort of patients at a higher dose of IMX-110 in combination with tislelizumab. The primary endpoints of the IMMINENT-01 trial include determining treatment-related adverse effects, the maximum tolerated dose, and the recommended phase 2 dose (RP2D). Secondary endpoints are focused on the plasma concentration of IMX-110, the objective response rate, progression-free survival, overall survival, and duration of response. These early results suggest that the combination of IMX-110 and tislelizumab could potentially unlock new treatment possibilities for patients with advanced CRC, supporting the scientific rationale behind the use of IMX-110 to enhance the immune system’s ability to fight cancer.

Financials

The company has approximately $15 million in cash and an EV of $80 million. The cash runway is about 12 months. A secondary raise of $10-15 million appears to be reasonable given the market cap of $100 million. Clinical progression of NXC-201 is key. NXC-201 is the equivalent of Phase 3 drug in terms of its clinical progression under ODD, a massive savings in terms of time and money. The average Phase 3 drug company has an EV of $1 billion.

There are 19 million shares outstanding. As of September 30, 2023, the company had a total of 2,311,161 warrants outstanding and exercisable, with a weighted-average exercise price per share of $0.71. Among the outstanding warrants, there are pre-funded warrants to purchase 1,913,661 shares of common stock with an exercise price of $0.0001 per share. These pre-funded Warrants will not expire until they are exercised in full.

N-Genius Platform Potential

The technology, which has produced NXC-201, has the potential, the company claims, to expand 10-20x in potential increase in CAR-T addressable market through wider hospital availability and ~5x potential hospital per-bed revenue increase by reducing CAR-T hospitalization time. Overcoming neurotoxicity (20-30% for others) could allow its current niche therapeutic targets to expand into autoimmune disorders and other large unmet needs.

The platform consists of three key elements: (1) purpose-built cell therapy evidence capture engine + relational database, which relates ImmixBio internal data to external to accelerate therapy design, manufacture, and preclinical; (2) proprietary EXPAND technology, which is applied to multiple cell therapy indications, already utilized to create NXC-201, to potentially increase efficacy and tolerability; and (3) atomized, novel binding scaffold generation engine, which allows us to make the correct binding for every molecule. We believe key characteristics of NXC-201 may apply to other products candidates produced by the N-GENIUS Platform. Those 3 key characteristics are: (a) high transduction efficiency (lower dose may lead to lower toxicity), (b) low tonic signaling (lower off-target toxicity may lead to lower toxicity), and (c) anti-exhaustion capability (increased persistence may lead to efficacy over an extended period of time).

Team

I met the team on a zoom call on January 23, 2024. They were both technical and commercial, a great combination of traits for a biotech.

Ilya Rachman MD PhD, Chief Executive Officer

Dr. Rachman is a physician/scientist and former community clinical faculty at UCLA. He received both his MD and PhD from the University of Illinois, and his MBA from UCLA Anderson. Ilya founded a Clinical Research organization that conducted clinical trials of pharmaceutical drugs, and is also currently the CEO of Immix Biopharma, Inc. He has completed several clinical trials as a Principal Investigator and developed strong relationships in the clinical research industry.

Gabriel Morris, Chief Financial Officer

Gabriel Morris is the Chief Financial Officer of Immix Biopharma, Inc. Mr. Morris has been managing partner of Alwaysraise LLC, a life sciences advisory and investment firm based in San Francisco, since founding. Prior, Mr. Morris was the interim Chief Financial Officer of Zap Surgical Systems, a brain radiosurgery company, where he completed a growth equity financing round. Prior, Mr. Morris led cross-border mergers & acquisitions transactions at Goldman Sachs and other global investment banks for more than a decade, where he participated in greater than $50 billion in completed transactions. Mr. Morris received his B.A. from the Columbia University in the City of New York.

The ideas presented on this site do not constitute a recommendation to buy or sell any security. Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SYNTHETIC.COM nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance. SYNTHETIC.COM posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. The material on this website is provided for information purpose only. SYNTHETIC.COM does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, recommendations, warranties or conditions of any kind.