Creating a valuation estimate for a biotechnology company in Phase 2 trials is as risky as the biotech itself. In the case of Viking Therapeutics (VKTX), I believe the exercise is worth the effort given the rapid adoption of GLP-1 agonists (sometimes referred to as incretins), for the treatment of diabetes and weight loss – and now heart disease.

Appraising a company’s value with NPV analysis is a useful exercise despite the uncertainty of forecasting a new, emerging drug class – together with artful projection of the transformation of a biotech into a mature pharmaceutical company. Potential investors should note that NPV estimations are imprecise and speculative.

There is a clear path for this new class of drugs to impact population-level disease states and deliver on improvements in terms of efficacy and side-effects in the newer generation of dual agonists, such as the drug candidates being developed by VKTX. The bigger picture here is that the naturally-occurring gut neurotransmitter GLP-1 agonists contain a trojan horse of potential (satiety, addiction, craving) when escalated to a brain-infusing hormone at the dose level of these synthetic GLP-1s agonists. It’s the perfect drug class for the world’s richest billion people who suffer from abundance.

Signs Point To Massive Market Potential

There are signs that suggest GLP-1 agonists could be a once-in-a-lifetime investment opportunity, and VKTX has a potential to be best-in-class among existing competitors. These signs are:

- Sales of Eli Lilly’s dual agonist GLP-1 diabetes drug, Mounjaro (tirzepatide), approved in May 2022, exceeded $5 billion in 2023, its first full year on the market. UBS estimates the drug could reach a sales high of $25 billion annually;

- 30% of all GLP-1 agonist proscriptions were estimated to be unfilled in 2023 due to manufacturing shortages;

- Upstream benefits: FDA has just approved a new use for Wegovy to reduce the risk of adverse cardiovascular events;

- Novo Nordisk says its target market is the 764 million people with obesity across the globe;

- VKTX’s clinical results (pill and intravenous) have shown to be superior in terms of efficacy and tolerability.

- Novo Nordisk will test whether its GLP-1 drugs can help people with alcohol-associated liver disease – anecdotal reports have suggested GLP-1 drugs could serve as potential broad addiction treatment;

- Eli Lilly reported positive results for its obesity drug Zepbound in obstructive sleep apnea;

- GLP-1s have propelled Novo Nordisk to become the largest company in Europe;

- Almost 90% of US adults met criteria for Cardiovascular-Kidney-Metabolic (CKM) syndrome (stage 1 or higher) and 15% met criteria for advanced stages, neither of which improved between 2011 and 2020.

Comparison to Statins

Today, nearly 50 million Americans take statins, yet cardiovascular disease has not been diminished after decades of so called treatments. This is why the industry is careful to describe statins as a “risk reducer” and not simply a reducer of disease. Similarly, statin clinical studies, the ones available for public consumption, focuseon relative risk as opposed to total risk. While GLP-1s have enjoyed an expansion in indications, clinical guidelines have expanded the proportion of people eligible for statins as ‘ideal’ LDL cholesterol levels were incrementally lowered. For example, one study estimated a 600% increase in eligibility for statins between 1987 and 2016. The relative risk reduction for those taking statins compared with those who did not was 9% for deaths, 29% for heart attacks and 14% for strokes. Yet the absolute risk reduction of dying, having a heart attack or stroke was 0.8%, 1.3% and 0.4% respectively. And this is before accounting for the side-effects.

Lipitor (atorvastatin) was introduced by Pfizer in 1996. It quickly became the best-selling statin and one of the most prescribed medications for lowering cholesterol. Cumulative sales surpassing $150 billion before its patent expired in 2011. This was more than a decade after the first statins were introduced in the 1980s. Lipitor was the 4th statin to go to market.

The point here is that the first drugs in a new drug class may not be the best or highest-selling once the market matures. And it’s possible to create a massive new drug class on flimsy data. Unlike statins, GLP-1 data is much richer with powerful upstream benefits, so my estimates of patients served and revenues generated is much higher.

Clinical Progression – VK2735

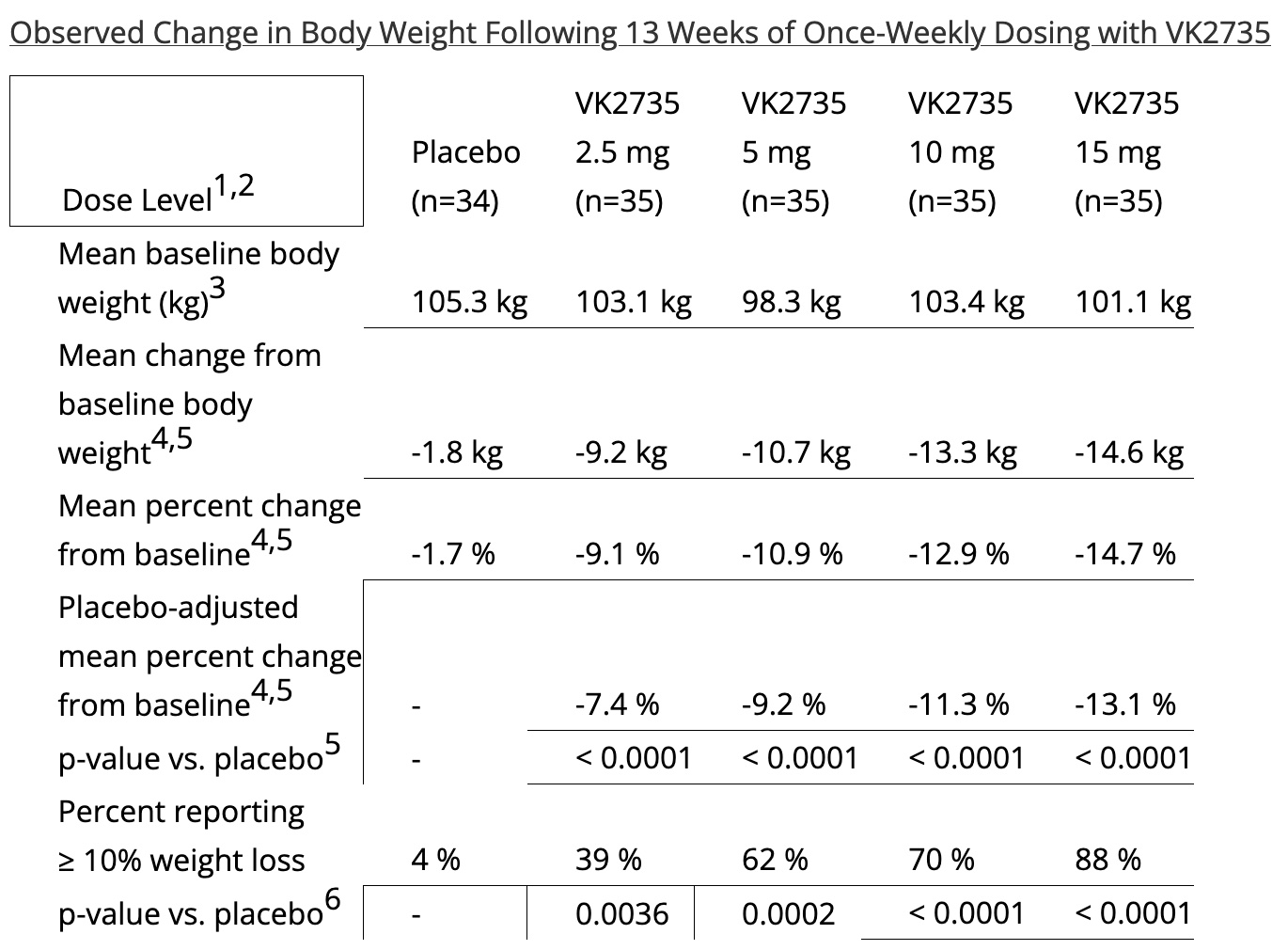

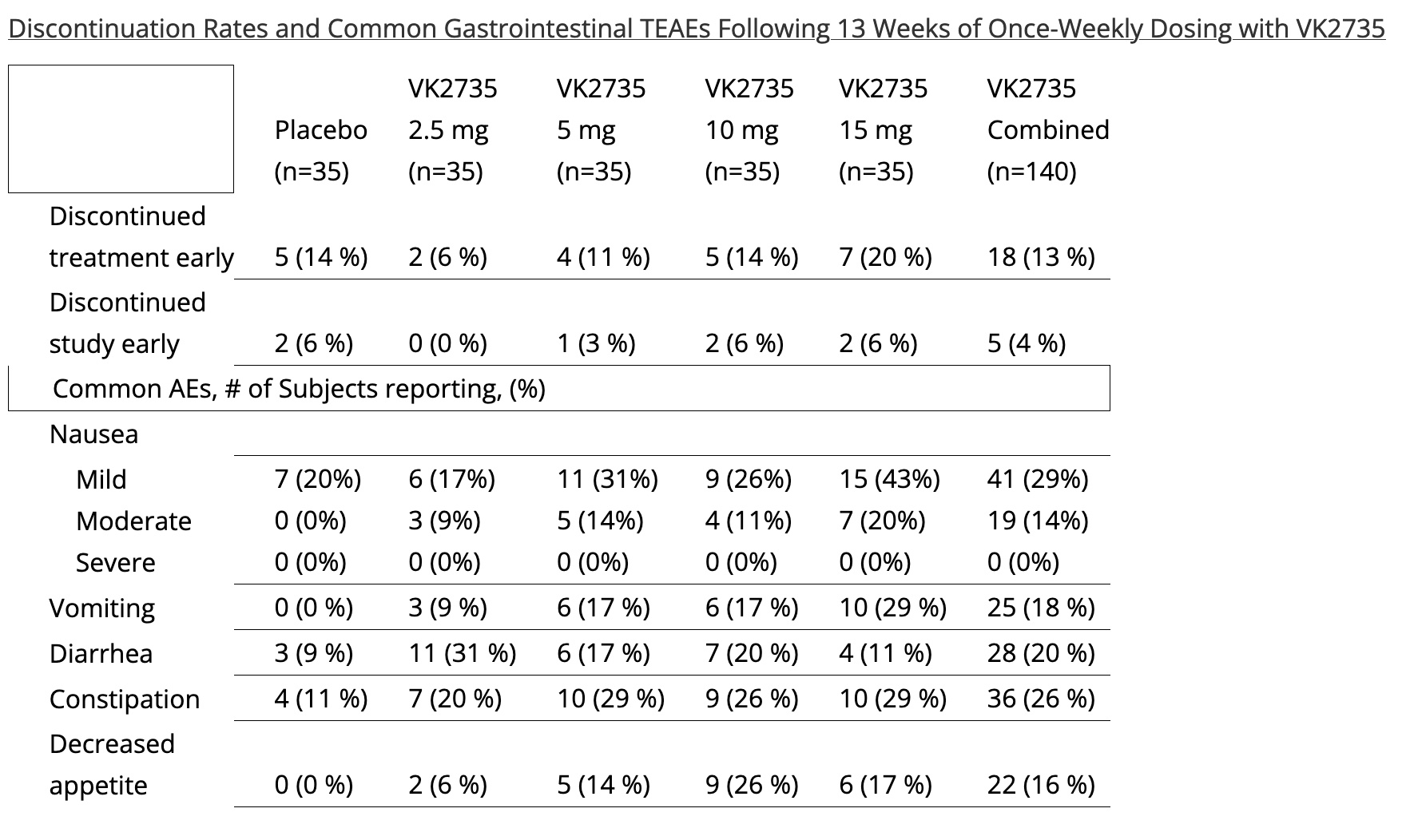

In February 2024, VKTX announced positive top-line results from Phase 2 VENTURE trial of dual GLP-1/GIP receptor agonist VK2735 in patients with obesity. Results: Up to 13.1% placebo-adjusted mean weight loss (14.7% from baseline) observed after 13 weeks of treatment; No plateau observed. VK2735 also demonstrated to be safe and well-tolerated in 13-week study; 95% of GI-specific treatment emergent adverse events considered mild or moderate. VK2735 appears promising when compared to current options, although cross-trial comparisons can be tricky. After 13 weeks, participants in Novo Nordisk’s phase 3 trial for semaglutide had not yet lost 10% of their body weight. Eli Lilly’s tirzepatide resulted in quicker and more significant weight loss than semaglutide. So VK2735 seems competitive with tirzepatide as well.

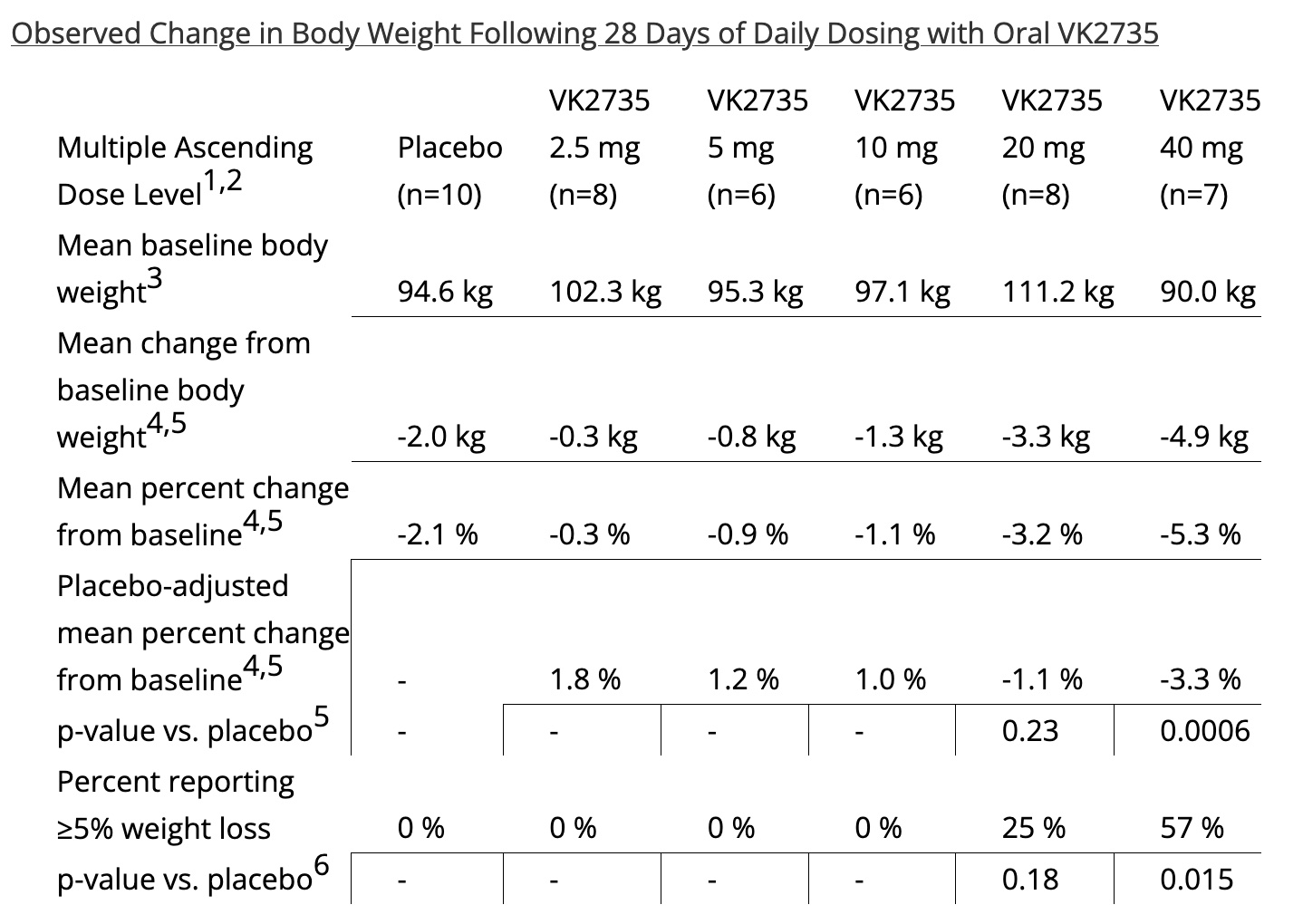

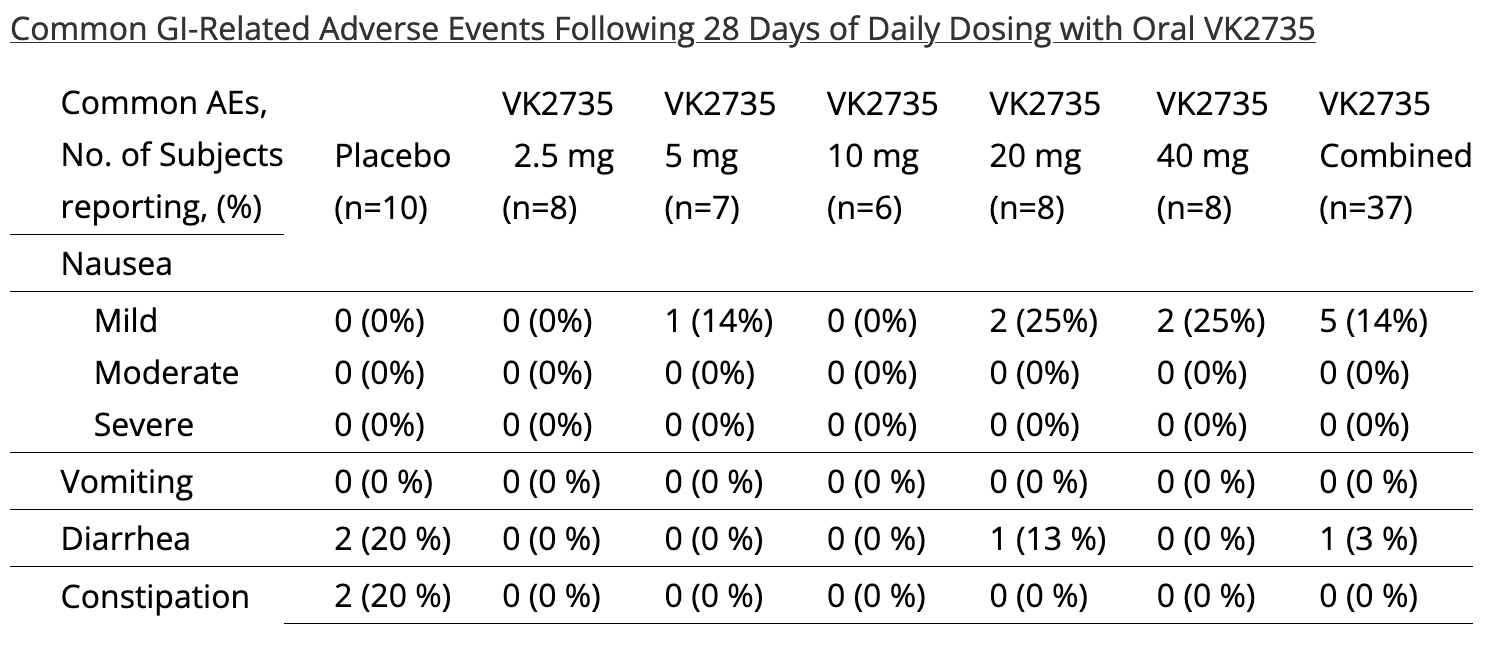

In March 2024, VKTX’s Phase 1 clinical trial of oral pill formulation of its dual GLP-1/GIP receptor agonist, VK2735, demonstrated 3.3% placebo adj weight loss in the highest dose cohort (40mg QD, n=7) at 28-days with an excellent Gl tolerability profile.

NASH

The outlook for nonalcoholic steatohepatitis (NASH) is a shifting landscape. MASH prevalence is a remarkable >6% of the US population (>20mn in the US) – and likely to be higher as it is the last stage of metabolic syndrome. The newer dual agonist could have an impact. For example, semaglutide and tirzepatide have shown positive effects in NASH. And there is likely a role for oral maintenance treatments, such as liver-targeting THRβ agonists, and VKTX’s VK2809, to manage fibrosis. Also, about 20% of NASH patients are considered to have “skinny NASH,” in which case GLP-1 agonists would not be appropriate.

Bottom line: the MASH treatment landscape will continue to evolve with varying needs for the diverse, growing patient population.

GLP-1 Agonist TAM

Soon, GLP-1s will become the largest drug class ever, overtaking statins, a drug that has dubious net benefits for society.

How big could the drug class become? Estimates are rising fast along with the number of indications addressable by GLP-1s. Goldman Sachs estimates the drug class’ impact could improve US GDP by up to 1%. They add, “While this uncertainty generates a wide range of potential outcomes for treatment, our analysts’ median scenario predicts the number of Americans treated with GLP-1 therapies will triple to 30 million by 2028, with upside to as many as 70 million.”

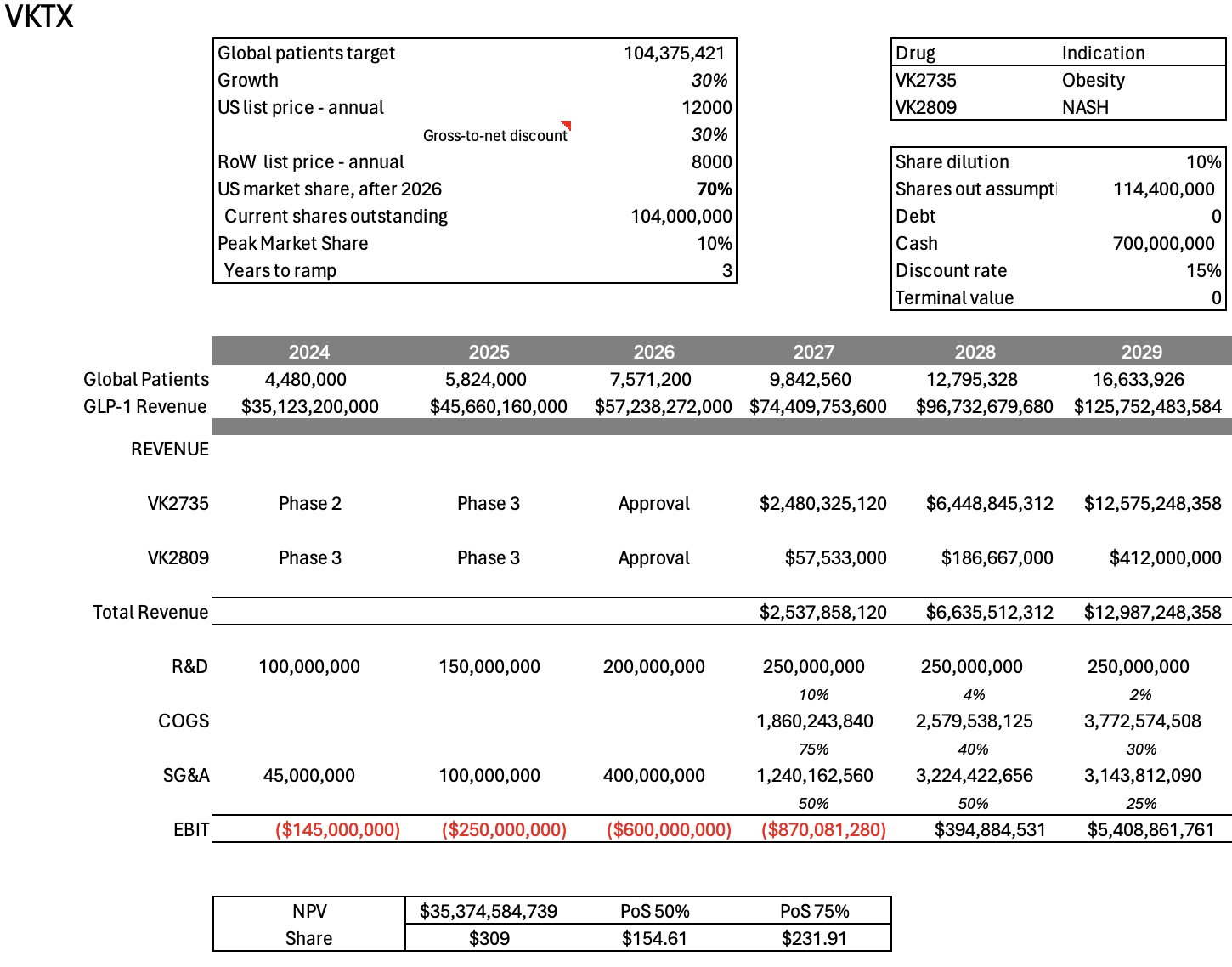

UBS estimates global GLP-1 model forecasts 40m people on GLP-1s by 2029, with 44% in the US. This translates into $126bn sales by 2029, a 2023-2029 sales CAGR of 30%. And Goldman’s median scenario predicts the number of Americans treated with GLP-1 therapies will triple to 30 million by 2028, with upside to as many as 70 million.

I’m assuming a ramp to approximately 100 million patients globally by 2036 and nearly $800 billion in global sales, unadjusted for inflation.

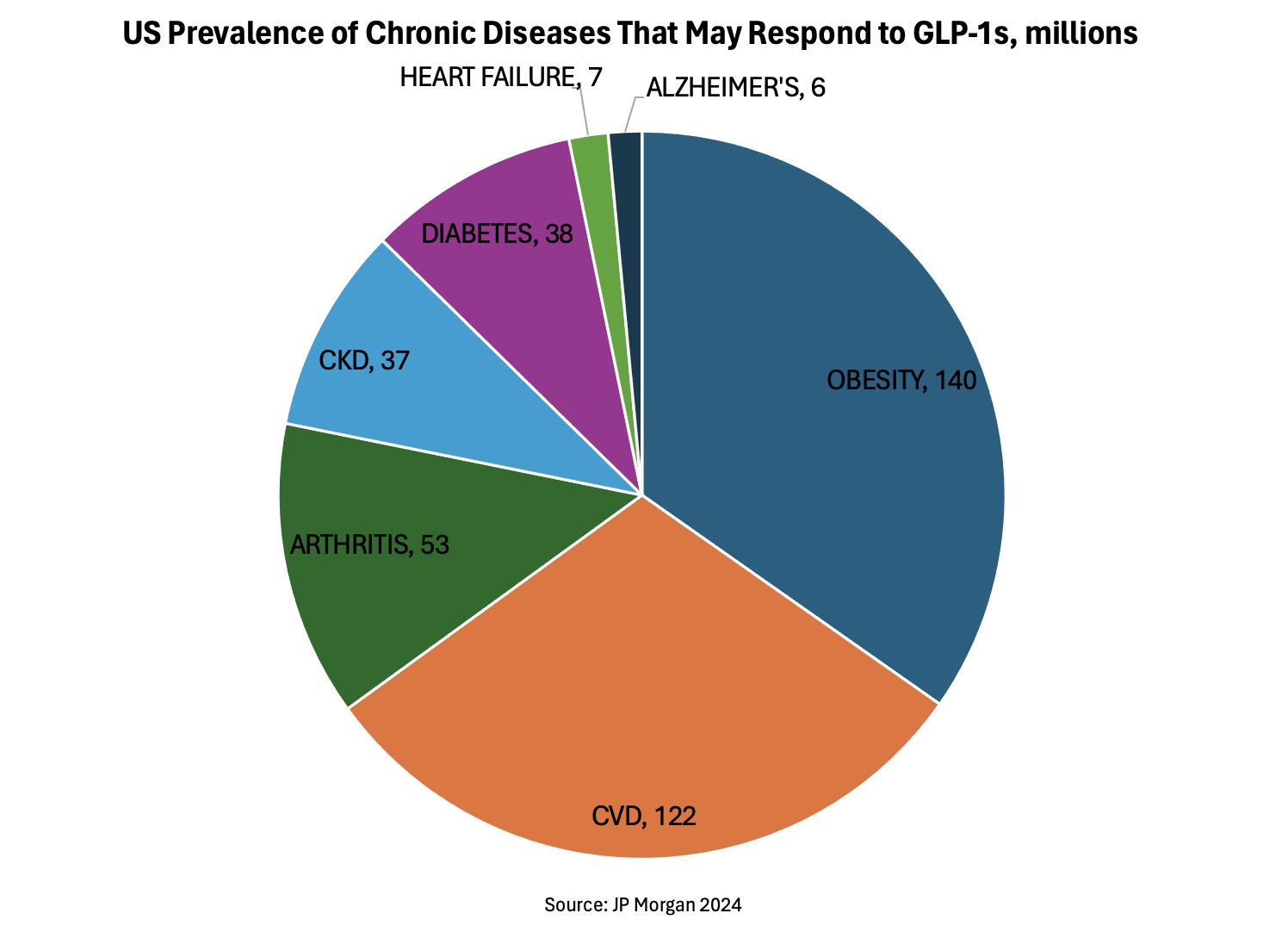

As disease indications for GLP-1 expand, the treatment population literally explodes higher.

Insurance and Medicare Coverage

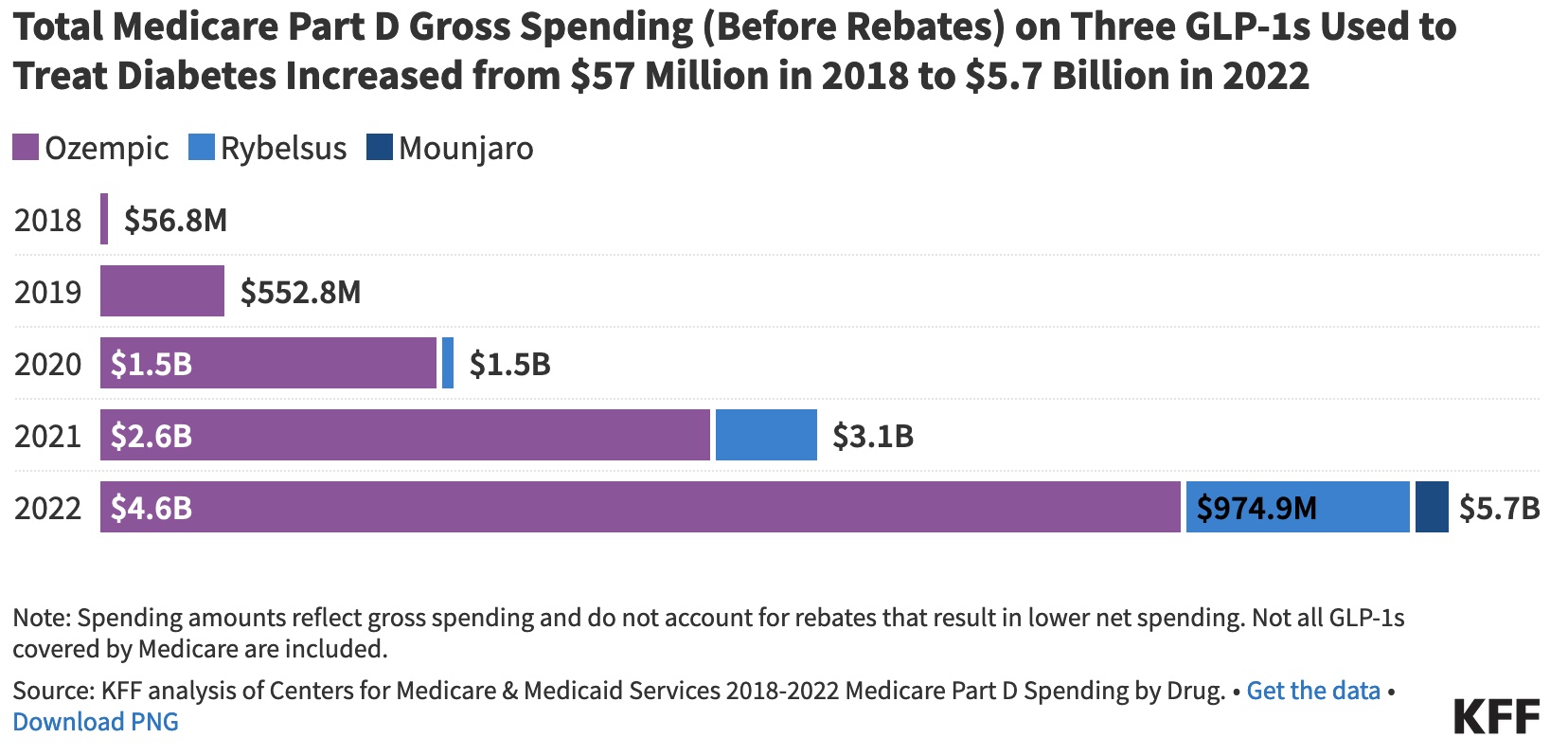

Medicare is prohibited under current law from covering drugs used for weight loss, but Medicare Part D plans cover GLP-1s for their other medically-accepted indications, including to treat diabetes, and now to cut cardiovascular risk, based on a recent memo from the Centers for Medicare & Medicaid Services (CMMS).

A majority of corporate health insurance plans offer GLP-1 drug coverage for diabetes, with only about one-quarter extend that to weight loss.

Under one extreme scenario, GLP-1 could cost to the federal government $1 trillion per year. But it brings up a good question: what are the benefits of dramatically reducing CKM syndrome instead of having it continue to rise.

I’m assuming coverage will grow as more additional indication show powerful upstream benefits. Eventually, the government will pay because CKM syndrome will otherwise bankrupt the country.

Open Questions

Known risks: clinical, competitive, regulatory, reimbursement, IP, financial, commercial, pricing

Assumptions

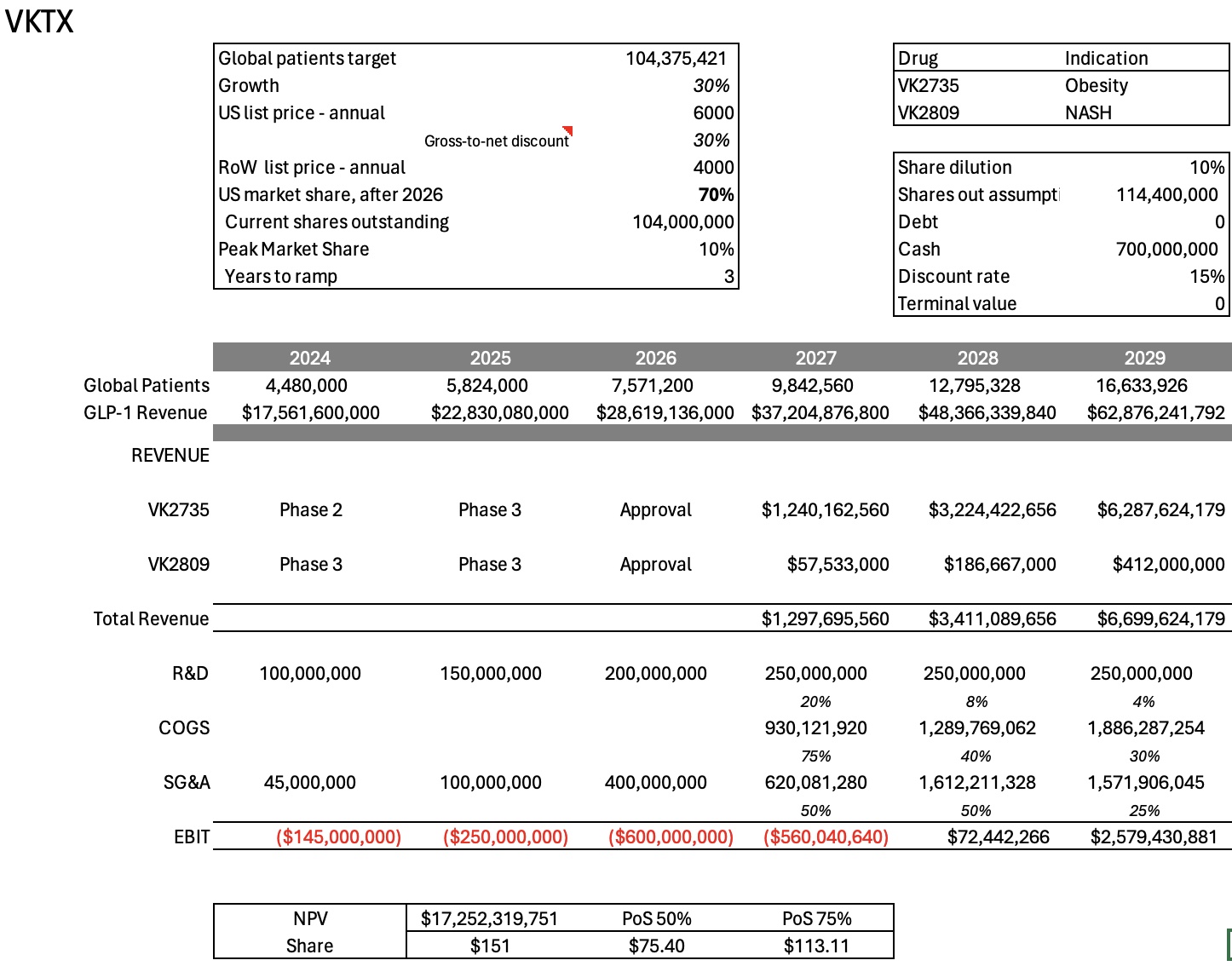

- GLP-1 sales for 2023 were approximately $29 billion – and it is estimated that 30% of prescriptions could not be filled due to shortages. As such, I have moderated the drug class’s growth rate in 2024 to reflect manufacturing shortages;

- Revenues are modeled through patent expiry, so no terminal value;

- Gross-to-net discount constant: 30%;

- Discount rate: 15%

- VK2809 (NASH) estimates are from Stifel (March 16, 2024);

- VKTX market share at peak: 10%, years to ramp: 3, starting in 2027;

- VKTX patents expire in 2037;

- USA GLP-1 market share 80% until 2026, then 70%;

- USA pricing today is about $15,000/year. I assume pricing $12000/yr, RoW 8000/yr;

- 10% share dilution from current level;

- No accounting for depreciation, taxes, amortization or tax loss carryforwards;

Here are NPV price ranges at full price assumption:

Here are NPV price ranges at 50% price assumption:

The ideas presented on this site do not constitute a recommendation to buy or sell any security. Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SYNTHETIC.COM nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance. SYNTHETIC.COM posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. The material on this website is provided for information purpose only. SYNTHETIC.COM does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, recommendations, warranties or conditions of any kind.