Cullinan Oncology, LLC, a Cambridge, MA-based company, plans to raise about $150 million by offering 8.3 million shares at a price range of $17 to $19. At the midpoint of this range, Cullinan’s market value would be $750 million, fully diluted.

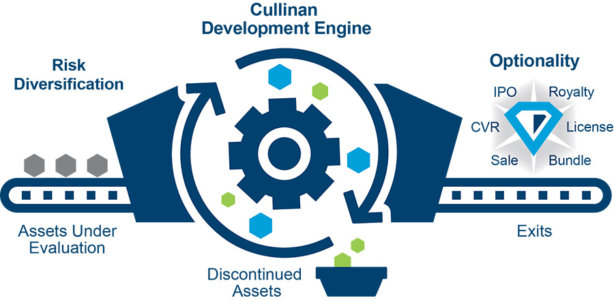

The company is focused on developing a diversified pipeline of targeted oncology and immuno-oncology therapies. Cullinan’s strategy is to build a pipeline of therapeutic candidates that are uncorrelated across multiple dimensions, with a focus on assets that it believes have novel technology, employ differentiated mechanisms, are in a more advanced stage of development than competing candidates, or have a combination of these attributes. In approximately three and a half years, the company has developed or in-licensed a pipeline of seven programs and claims to leverage a “hub-and-spoke” business model.

Finance theory underpins the company’s strategy. In essence, modern portfolio theory (MPT) informs Cullinan’s drug development allocations into a portfolio that can, “optimize expected returns while mitigating risk.” The company invests in a broad array of oncology assets diversified across indication, mechanism and modality that results in a collection of uncorrelated oncology assets that, “maximizes optionality while mitigating risk.”

The company claims to prioritize the probability of success and capital efficiency, as follows: before advancing a therapeutic candidate into clinical development, it evaluates its ability to generate an immune system response or to inhibit oncogenic drivers as a single agent. Cullinan claims to have terminated programs that do not meet it rigorous criteria for advancement and will continue to do so when it believe we can more efficiently allocate capital.

Your correspondent wonders: If the limiting factor in drug discovery and development success were a function of very early-stage immune system response signals, then the process would be a deterministic model with funding as the only barrier – no need for all the hard work sorting through the false signals.

Cullinan has one clinical-stage targeted oncology candidate in Phase 1/2a development and six preclinical immuno-oncology candidates and programs. According to the company, the future holds at least one therapeutic candidate into the clinic and one program into IND-enabling studies each year for at least the next several years.

MPT assumes that investors are risk-averse and that an investor must be compensated for a higher level of risk through higher expected returns. The expected return of the portfolio is calculated as a weighted sum of the individual assets’ returns – not sure how returns are calculated when therapeutic assets are sink holes for cash and early signals are filled with noise. Innovation in drug discovery and development is hard to do; combine it with innovation in a business model and the risks pile up, as was the case with Intrexon, the first synthetic biology IPO.

Pipeline

Cullinan’s lead candidate, CLN-081, is an orally available small molecule designed as a next generation, irreversible epidermal growth factor receptor, or EGFR, inhibitor that is designed to selectively target cells expressing mutant EGFR variants, including EGFR exon 20 insertion, or EGFRex20ins, mutations, with relative sparing of cells expressing wild type EGFR.

The company is currently evaluating CLN-081 as a treatment for non-small cell lung cancer, or NSCLC, in adult patients with EGFRex20ins mutations in a Phase 1/2a trial. Its most advanced immuno-oncology therapeutic candidates include CLN-049, a bispecific antibody targeting FLT3 and CD3; and CLN-619, a monoclonal antibody designed to stimulate natural killer, or NK, and T cell responses by engaging a unique target, MICA/B. It intends to initially develop CLN-049 for the treatment of acute myeloid leukemia, or AML, and CLN-619 for the treatment of solid tumors.

In addition, through its AMBER platform, Cullinan is developing CLN-617, a fusion protein combining, in a single agent, two potent antitumor cytokines, interleukin-2, or IL-2, and interleukin-12, or IL-12, fused with a novel collagen-binding domain designed to enable tumor retention for the treatment of solid tumors.

Its pipeline includes three additional immuno-oncology programs in the lead optimization stage that it believe have compelling mechanisms of action and potential for clinical development. It currently holds worldwide development and commercialization rights to each of our therapeutic candidates, except for CLN-081 in Japan and Greater China.

Source: Cullinan Oncology, LLC

The ideas presented on this site do not constitute a recommendation to buy or sell any security. Investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is not indicative of future price action. You should be aware of the risks involved in stock investing, and you use the material contained herein at your own risk. Neither SYNTHETIC.COM nor any of its contributors are responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made on this site do not provide, imply, or otherwise constitute a guarantee of performance. SYNTHETIC.COM posts may contain financial reports and economic analysis that embody a unique view of trends and opportunities. Accuracy and completeness cannot be guaranteed. Investors should be aware of the risks involved in stock investments and the possibility of financial loss. It should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. The material on this website is provided for information purpose only. SYNTHETIC.COM does not accept liability for your use of the website. The website is provided on an “as is” and “as available” basis, without any representations, recommendations, warranties or conditions of any kind.